capital gains tax canada vs us

The other forms of investment income are interest and dividends. In the above example if it was simply a stock on the TSX then the capital gain would be 500 minus commissions.

Capital Gains Tax Or Income Tax Which Is Better For You In 2021 Capital Gains Tax Income Tax Capital Gain

Canadian investors are forced to pay capital gains tax on 50 of their realized capital gains.

. Capital gains are subject to the normal CIT rate 18 or 13 for entities producing goods or 20 for the activities of financial institutions and mobile companies. Interest income is 100 taxable in Canada while dividend income is eligible for a. In Canada 50 of the value of any capital gains is taxable.

Canada Safeway Limited v. Capital gains tax canada vs us. And Canada have considerably different systems of taxation related to the estates of deceased persons.

This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26765 in Canadian capital gains tax on the 1000 in gains. But another thing to consider is the inclusion rate.

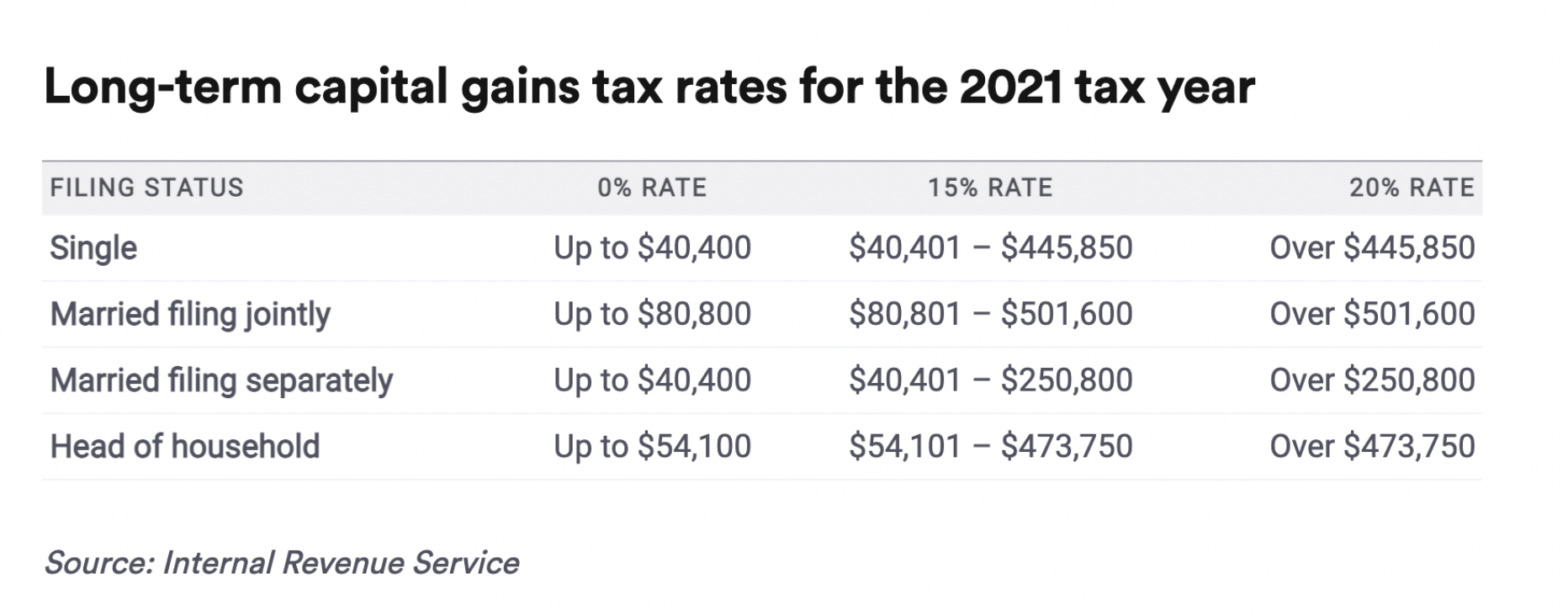

State Taxes on Capital Gains. So this means youll pay tax on half of your capital gains. The US tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains for.

The amount of tax youll pay depends on how much youre earning from other sources. In our example you would have to include 1325 2650 x 50 in your income. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status.

The tax rate for these transactions is identical to the individuals marginal tax rate. Some states also levy taxes on capital gains. If losses are 3000 more than gains you can carry them forward.

730 minus commissions x 50 x marginal tax rate. Canada 1995 SCR 103 Capital Property or Business Income. Estates in Canada For Canadian purposes a Canadian resident is deemed to have disposed of all property owned at the date of death at fair market value thus triggering capital gains tax on any unrealized capital gains.

The us tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains for this purpose. The sale price minus your ACB is the capital gain that youll need to pay tax on. In the US capital losses can reduce capital gains and up to 3000 of regular income.

From 1954 to 1967 the maximum capital gains tax rate was 25. The Queen 2014 TCC 208 Unsolicited Offers. So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level.

The additional deduction is calculated as the difference between 500000 12 of 1000000 and the 406800 limit. Under Canadian tax law individuals need to pay tax only on 50 percent of their capital gain instead of paying tax on 100 percent of the capital gain. In Canada capital losses can only be used to reduce capital gains.

If capital losses in one year are more than capital gains you can use it to reduce capital gains in up to three previous years or any future year. The capital gains deduction limit on gains arising from dispositions of QSBCS and QFFP in 2015 is 406800 12 of a LCGE of 813600. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket.

The capital gains tax rate in Ontario for the highest income bracket is 2676. They are generally lower than short-term capital gains tax rates. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

If you are being audited for the sale of property call us today to see how we can help. The capital gains tax on most net gains is no more than 15 percent for most people. Canada taxes nonresidents at a rate of 25 on capital gains realized from the.

In 1978 Congress eliminated the minimum tax on excluded gains and increased the exclusion to 60 reducing the. The tax rate on most net capital gain is no higher than 15 for most individuals. Since October 2000 the capital gains inclusion rate in Canada has been 50 meaning that upon the death of Canadian taxpayers half of any previously unrealized appreciation on capital assets gets taxed leading to tax at rates as high as 27 depending on the province of residence of the deceased taxpayer.

Capital Gain Tax Rates. 143 on day of sell trade Sell CAD. Most states tax capital gains according to the same tax rates they use for regular income.

Canada did not tax capital gains. Her Majesty the Queen 2008 FCA 24 Primary and Secondary Intention. Generally only capital gains accruing subsequent to December 22 1971 as to publicly traded shares and December 311971 as to other property are subject to taxation.

This determines how much of your capital gains youll have to pay tax on. Capital gains tax rules. It would result in paying taxes in the US as the Canadian taxes paid on the 50 portion of the capital gain is not enough to offset the US taxes on the capital gain.

For dispositions of QFFP after April 20 2015 the LCGE is 1000000. This means the tax rate on capital gains in canada is half of your marginal tax rate the rate top rate bracket your income falls into. A capital gain rate of 15 applies if your taxable income is.

See Income Tax Act 115. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. Currently its 50 in Canada but has been as high as 75 historically.

Marginal tax rates are composed of a federal component which is paid in the same amount by all Canadians and a provincial component which varies depending on which province you live in. When a Canadian resident non-citizen of the US sells their vacation property in Florida any capital gain realized is subject to US tax and withholding but is also subject to Canadian tax. Capital gains are treated as other income subject to 15 rate.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Our Cas Are Here For You To Solve Any Tax Related Queries You Just Need To Ask Call 01762517417 91 6283275634 Income Tax Return Tax Deductions Income Tax

Capital Gains Tax Capital Gain Integrity

Flipping Houses Taxes Capital Gains Vs Ordinary Income 2019 Flipping Houses Buying A Rental Property Capital Gain

Capital Gains Tax In Canada Explained Youtube

Capital Gains Definition 2021 Tax Rates And Examples

Canadian Taxes For U S Investors The Comprehensive Guide

The Capital Gains Tax And Inflation Econofact

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax Calculator For Relative Value Investing

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Capital Gains Tax Calculator For Relative Value Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

Capital Gains Tax Capital Gain Integrity

Capital Gains On Rental Property What Is It And How To Avoid It Capital Gains Tax Capital Gain Gain